Popular Posts

You might be forgiven for worrying about why stocks go up, or down, in the past few months.

After all, we’re well into the longest bull market in history, an election is around the bend, and much of the longstanding economic order, such as our trade deals, seems to be in question.

On the other hand, the Federal Reserve has again raised interest rates a bit, largely because the economy is doing so well that the bank’s chiefs feel the need to tap the brakes.

It makes for a lot of mixed signals, and that can be worrying to investors. It’s in these moments it helps to remember the words of Benjamin Graham, the longtime mentor of billionaire investor Warren Buffett.

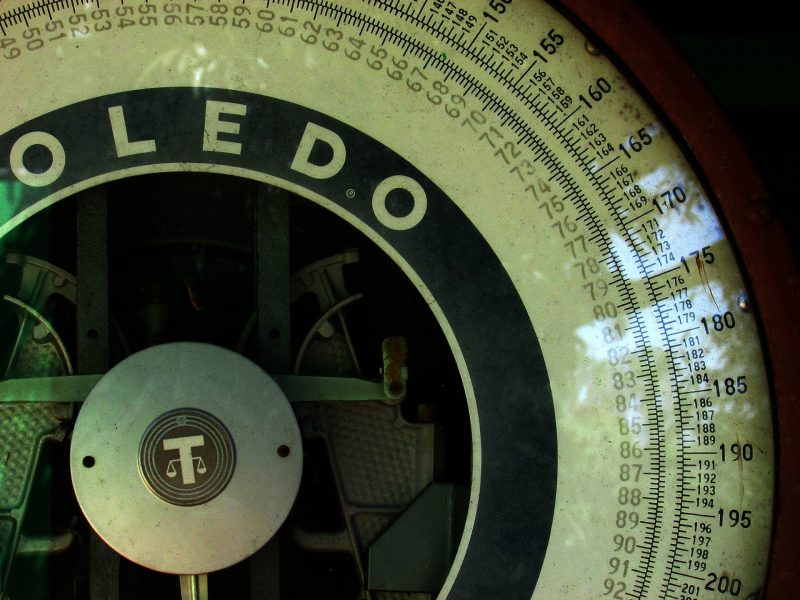

Graham once wrote: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

That really sums up the problem with trying to time your entries and exits from a stock, and even from the entire stock market.

Chances are, you’ll get it wrong.

The reason why you’ll be wrong is human nature. We like being on the winning team. If everyone is buying, we want to be buyers.

If everyone is selling, we also want to be sellers. That can lead to some maddening moments in the stock market. A sudden exit by a few can compound, turning into a sharp decline thanks to others following them out.

But, remember, for every single seller there has to be a buyer. Stocks don’t get sold into the ether. They don’t get returned to inventory or sent back to a factory.

Somebody is buying the shares others are selling. To them, a price that was okay has suddenly turned even better.

All that buying and selling, in Graham’s words, is just voting. Like with any voting, things can get noisy and, in the noise, one finds little meaning.

It’s as if we held political elections every single day of the year, nonstop. Imagine the uncertainty in that.

But the fact of the matter is that it’s very hard to turn away from the long-term gains found in stock ownership. That data backs up the long view on why stocks go up and that creates buyers for the sellers who have decided to get out.

If your horizon is years out, it’s very hard to justify selling. The effect of the long-term view on stocks is that they are properly weighed and valued.

The market, in time, becomes an accurate weighing machine. Stocks that should be valued highly are valued highly. Others are not valued as highly.

The way to manage your portfolio over time is not to participate in the voting but watch out for the weighing. And an easy way to make sure you own the “right” stocks is to just own them all — or at least the biggest ones.

That’s the S&P 500 Index, a broad market index that captures the 500 largest U.S. firms. If you want to own smaller companies, there are various small-cap indexes, and international firms, too.

And there are bond indexes too, which own the entire bond market, here and abroad.

Let the voting happen without you, and worry more about the weighing. Your investment life will be calmer and, over the years, far more productive.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.