Popular Posts

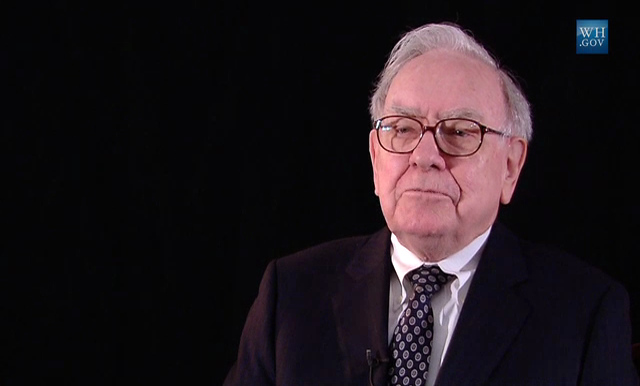

If you ever wanted to really understand Warren Buffett’s way of investing, you need only understand one basic thing.

“Time in the market” is more powerful than “timing the market.”

Buffett’s holding company, Berkshire Hathaway, has seen an average annualized gain of 20.8% since 1965, more than double that of the S&P 500 at 9.7%.

Where that really pays off, though , is compounding. Over those 52 years, a $10,000 investing in the stock market index grew to $1.28 million.

The same investing in Buffett’s way grew to $197 million. Big difference!

So how can you harness this kind of power? Essentially, ignore the stock market. You can’t get it right, so don’t bother, Buffett told CNBC in an interview.

He sums this idea up in a disarmingly simple statement:

“You can’t predict what stocks will do in the short term, but you can predict that American business will do well over time.”

This is an echo of his days back at Columbia University, studying under his mentor Benjamin Graham.

Graham was the original stock picker, a man who seemed to know exactly which shares would rise and which would fall.

Graham used to talk of Mr. Market, an imaginary business partner representing the stock-buying public.

Some days, Graham said, your partner was euphoric and couldn’t be happier with the direction of the economy, as illustrated by a rising market.

Other days he was gloomy and ready to sell at any price to avoid declines.

What Buffett learned from Graham is that the short-term trader is much like Mr. Market. Always either manic or plunging into despair.

And you can safely ignore him because most the time, things go just fine. Stocks rise because American businesses know how to make money.

They tend to continue to make money, year after year, irrespective of how we feel about things.

In fact, the danger to your long-term investments is not any given stock you might own or the state of the economy itself.

It’s you.

“American business will do fine over time,” Buffett said. “The only person who can cause you to get a bad result in stocks is yourself.”

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.