Popular Posts

If the stock market stays steady for the next few weeks, we could easily end the year slightly up, slightly down or in virtually the same spot.

Stocks go flat. It happens. But that doesn’t mean they are a “bad” investment. Rather, it means that the stock market is working normally.

If you go back five years the rise in the S&P 500 index of stocks has been been impressive, an annualized 12.6% with dividends reinvested. Drop back to 10 years ago and it’s still a solid number, up just over 7% per year.

For the long-term investor, that’s good news. An annualized return of 7.2% will double your money every decade. Put in $10,000 and it turns into $20,000. Then, 10 years later, your $20,000 becomes $40,000. You never put in another cent and it doubles, then doubles again.

Compounding — the fact that investments grow dramatically the longer they stay invested — is a cornerstone of the financial world. Every pension fund and college endowment counts on it.

Owning your retirement investments in a tax-deferred account such as an IRA is a smart move. You save on taxes today and all of those extra dollars work harder for you by compounding.

Sure, the stock market might have a flat year now and again. It might even repeat the dramatic declines of 2008 and 2009.

Yet the risk in owning stocks isn’t the flat times or the bad times. Rather, it’s overreacting to these predictable moments and selling it all at a low point.

The answer is to not only to hold on to your stocks through the rough times but to see falling prices as an opportunity. As the billionaire investor Warren Buffett has noted, we love it when hamburger goes on sale. Load up the freezer!

Retirement investors should have exactly the same reaction to a flat year for stocks. It’s a great time to be a buyer. If you buy with discipline, a down year is a chance to lock in more shares at lower prices, lowering your total cost of stock ownership.

You still get dividends, currently just above a 2% return on the S&P 500 Index. If you have no current income needs, that money is plowed right back into the very stocks you are buying, supercharging your portfolio.

Cheer a flat year for stocks. Unless you’re retiring today, it doesn’t matter. The stock market is taking a breather, that’s all, and letting the economy catch up.

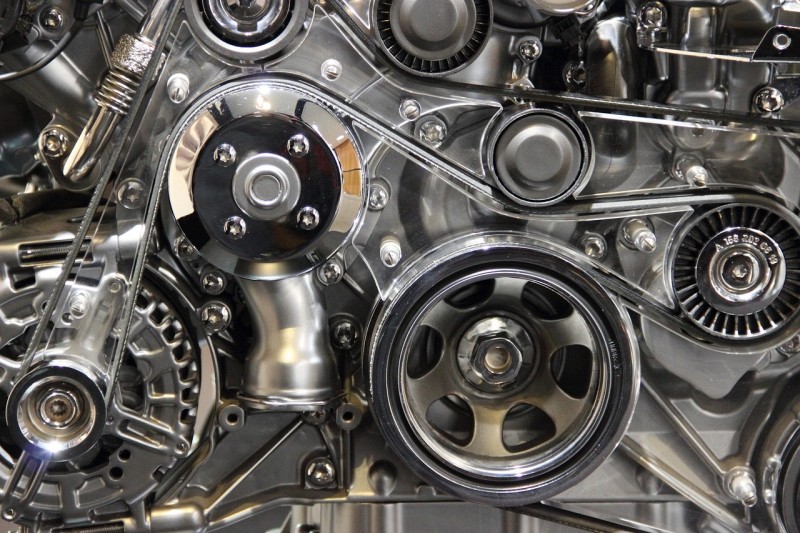

Over decades, in fact, you’ll find that stocks are by far the most powerful part of your retirement portfolio, beating bonds, commodities and cash. It’s the engine of your investment plan.

Five years from now you won’t remember or care what happened in 2015. Ten years on the whole year will be a blip and nothing more. In between, compounding and reinvesting will do the heavy lifting you need to retire with more.