Popular Posts

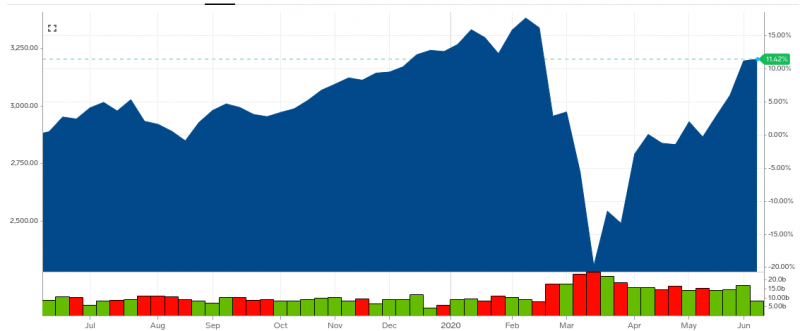

The first half of 2020 has been a wild ride for stock investors. After a record-setting decline in terms of speed, the S&P 500 Index of large U.S. stocks has mostly recovered.

That has some analysts and market pundits warning of a new decline. Incoming data from the Federal Reserve suggests that the second quarter will show a huge decline in economic growth — a more than 48% drop — and that could set off alarm bells once again.

Yet the fact remains that stock market reversals are not unusual. Bull markets last for years, even decades, while bear markets rarely stick around for longer than a few months. Some of those same analysts predicting a new decline for stocks nevertheless believe that the market could end the year in the green.

In that light, the fundamental question for investors is whether to hang on and wait out the bear or attempt to get out while times are good and wait to reinvest later.

S&P 500 Index, 1 year

As appealing as that thought might be, there’s ample reason to stay away from trying to time the market.

The problem with market timing is that you have to be right about the direction of stocks twice. You have to know the right moment to get out of stocks and then the right moment to get back in.

The research on individual investors behavior suggests strongly that most of us will not be right twice in a row. The problem is not access to information. The problem is our emotional response to what we see.

When stocks rise higher than we expect, there can be a strong feeling of lost opportunity. That emotional response can trigger an impulse to pile on and buy even more as stocks rise.

The result is buying high and then buying even higher.

When stocks go the other way our emotions can take over and force us to wait until the absolute bottom to sell. We believe we can take the stress of “losing” money (even if we have not sold) and wait until the pain is unbearable.

The result here is selling low, often at or near the very market bottom.

A far more reasonable approach is to buy steadily no matter what direction the stock market might be moving over days, weeks or months. When you step back and look at the market over decades, the inexorable trend is higher — even though there are declines along the way.

S&P 500 Index, 30 Years

If you are investing for a long run, that is, over periods of longer than 10 years, there’s no good reason to attempt to time the short-term gyrations of the stock market.

If you are investing for the short run, that is, for periods of less than five years, stocks might be less attractive. The risk of losses that cannot be recovered is high, and attempting to guess the direction of the market twice in a row is a nearly impossible feat.

Many people try and a few succeed. Often, those that succeed do so not as a result of access to information or superior understanding but sheer luck. Only after the fact does it appear that talent has overcome chance.

Then those investors try to repeat their performance and, usually, they give back their previous gains and then some.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.