Popular Posts

Fidelity Investments, the giant brokerage firm, does a pretty good job at breaking down our collective retirement readiness, measured as retirement income.

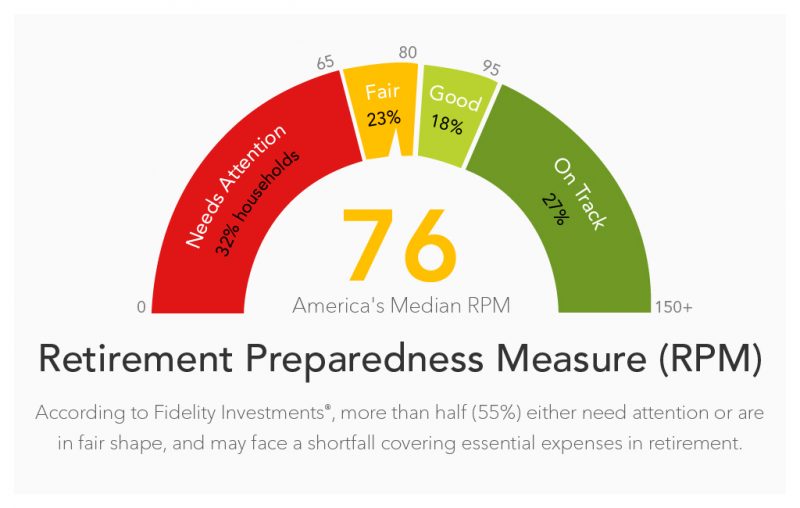

The most recent report from them shows that more than a quarter of Americans (27%) are “on track” with retirement savings. Another 41% of us fall between “good” and “fair” and 32% of us “need attention” when it comes to saving.

But what does that mean in cold, hard cash? From Fidelity’s perspective, on track means being able to cover 95% of pre-retirement expenses. Considering that many retirement advisors recommend covering at least 85%, this is a good number.

Good, in turn, means the basics are in hand but nothing discretionary, such as travel or entertainment costs. Not suffering, but definitely not living the same lifestyle as you did while working.

Fair suggests that adjustments to the lifestyle will be necessary. Fidelity doesn’t make any suggestions here, but one can imagine downsizing from a larger home or working part-time in retirement as a few potential adjustments.

Needs attention, of course, is where nobody wants to be. The financial future is murky and major adjustments loom. You might end up dependent on children or government aid to get by.

The great thing about this kind of analysis is that it deemphasizes the role of investing and returns, which nobody can predict or control. Instead, it puts the focus squarely on planning ahead.

Rather than think about a number, say, $1 million, think about what it actually costs you to live a full life. Will your mortgage be paid up by retirement, or is that years away? Will you buy a new car (or two) in your 60s?

Will you give money to your adult children with jobs, rather than thinking about your potential future health costs?

These are the kinds of pitfalls that can move one from “on track” to “needs attention” in short order. Planning ahead is the key to reducing real-life risk.

Here are three numbers you actually need to know before retiring:

1. Your actual cost of living, month by month, in retirement

2. Your expected payout from pensions and Social Security, now and in the future

3. How much of a gap results from these two numbers

For instance, if you know your mortgage is paid up and your cost of living is about $50,000 a year, including frills such as travel, that’s an important data point.

You might learn that taking Social Security at 65 will generate $24,000 a year. So how much do you need in your retirement investment income to create the difference of $26,000?

As it happens, that can be easily estimated. A portfolio of $650,000 earning 4% will pay out annual income of exactly $26,000. In this instance, the retiree doesn’t need $1 million. Far less will do it.

You can play with the figures any which way you would like. You might assume a “safe” return of 3% is more reasonable. Or that you put off Social Security a few years and get a few thousand more bucks a year.

A spouse’s savings or benefits might be part of the picture. Or perhaps you ramp up your savings rate to increase the private savings figure faster.

Importantly, research has show that retirees tend to spend more early on (cruises to Europe!) and later (medical care) but get conservative in-between, a curve known as the retiree spending smile.

The larger point is that worrying about the stock market is not the goal. Worry instead about having a good plan and the let the stock market take care of itself.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.