Popular Posts

Stock Market Timing: Systematic Losses

How many times have you overheard someone brag about their uncanny stock market timing? “Boy, I got out of stocks just in time!” or “We sold at nearly the high, … Read more

How Rich People Think About Money (Really)

Let’s talk about how rich people think about money, beginning with this famous quote: “Let me tell you about the very rich. They are different from you and me.” So … Read more

Dividend Strategy for the Serious Investor

Widows-and-orphans stocks. That’s what the brokers used to call the dividend strategy. During the go-go 1980s and later the tech boom, any stock offering a dividend was suspect, according to … Read more

Treasury Bubble: What’s the Next Move?

We’ve heard all about the alleged Treasury bubble building up. I’m not here to predict that it will burst, or even to say that it exists. (Being passive investors, we … Read more

Vanguard Funds: Three Magic Words

There’s a lot of serious data behind the performance of the Vanguard funds, but it can be boiled down to three magic words. Bear with me, we’ll get there quickly, … Read more

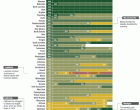

State Credit Ratings Reveal Who Is Really Broke

How broke is your state? You could rely on budget reports. But a lot depends on each state’s ability to tax its residents, which is a question of the economy. … Read more

Safest Investments Now, a Strange Twist

Where are the safest investments now? Just a few years ago, you probably would have said “money market funds, of course.” Yet financial historians soon will reflect back on the … Read more

Is Your Home An Investment? The Facts Are In…

Is your home an investment? Is anyone’s home a good, long-term asset? For a long time, the answer was yes. And real estate is still a good deal for investors, … Read more

Best Place to Invest Money Now? Blankfein Speaks

Think what you like about Wall Street (and its sometimes-obscure motivations), you’d be very lucky to buttonhole one of its brightest minds even for a few moments and ask the … Read more

Sell Your Company’s Stock In Your 401(k)

Finally – July 2012 has arrived! Employees all over America will get the sobering news that there really are fees being siphoned out of their 401(k) accounts and the amounts, … Read more