Popular Posts

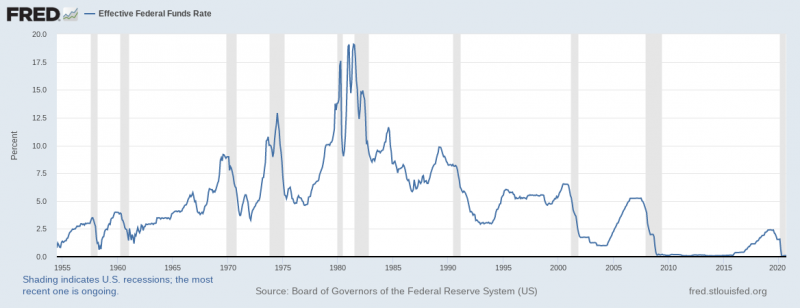

If you look at the long-term view on U.S. interest rates an interesting pattern appears: Virtually zero interest rates are essentially unknown from 1954 through 2009.

In fact, the most immediately arresting part of the graph is the early 1980s, when rates bordered an astounding 19%. Imagine trying to buy a home or borrow for a car under those conditions.

What happened since is what economists have long called “the great moderation” of low inflation, steady economic growth and declining rates — until 2009, when the housing market crashed.

The answer then was to make money cheap and to keep it cheap for years. Rates didn’t break above 1% until 2017, which is a long time.

Now the Federal Reserve, responding to the pandemic, is back to offering virtually free money. Low rates might be the norm for a few years based on the bank’s recent public statements.

This could all be a fairly academic discussion — who consults the Fed before taking out a car loan? — but for investors the idea of long-term low rates is a real conundrum.

Remember, bond prices and rates go in the opposite direction. As rates go up, bond prices go down and vice versa.

What that means for millions of retirement savers is that the premium they used to get for holding bonds in the form of higher bond prices is virtually exhausted. At the same time, the income they used to get from bonds also is zero and even negative after inflation.

Will rates stay down? Will they inevitably go back up and cause bond prices to fall, or perhaps crash?

Nobody really knows. If you did, you could easily load up on investments that would benefit from correctly guessing the direction of what amounts to trillions in global assets.

For the ordinary retirement investor the key is to manage the risk by spreading it effectively across a portfolio.

There could be times, in the next five to 10 years, when owning more bonds will be in your favor. And there could be times when that won’t be true.

Balancing your ratio of stocks and bonds to reflect your true time horizon is important. So is rebalancing periodically from one asset type to the other.

If you have many decades left before retirement, there is an argument to be made for minimizing your bond holdings. If you are only a few years away, the risk of owning mostly stocks is high. What if another swift stock crash happens and wipes out one-third of your savings in a week?

Finally, what alternatives to blue-chip stocks and U.S. Treasuries do you really have? Would owning foreign shares and debt make your portfolio more stable over time? Would real estate help?

These are reasonable questions that require the insights of a professional investment advisor and financial planner. But the first step is recognizing the risks in your portfolio as it stands today.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.